39 ytm for zero coupon bond

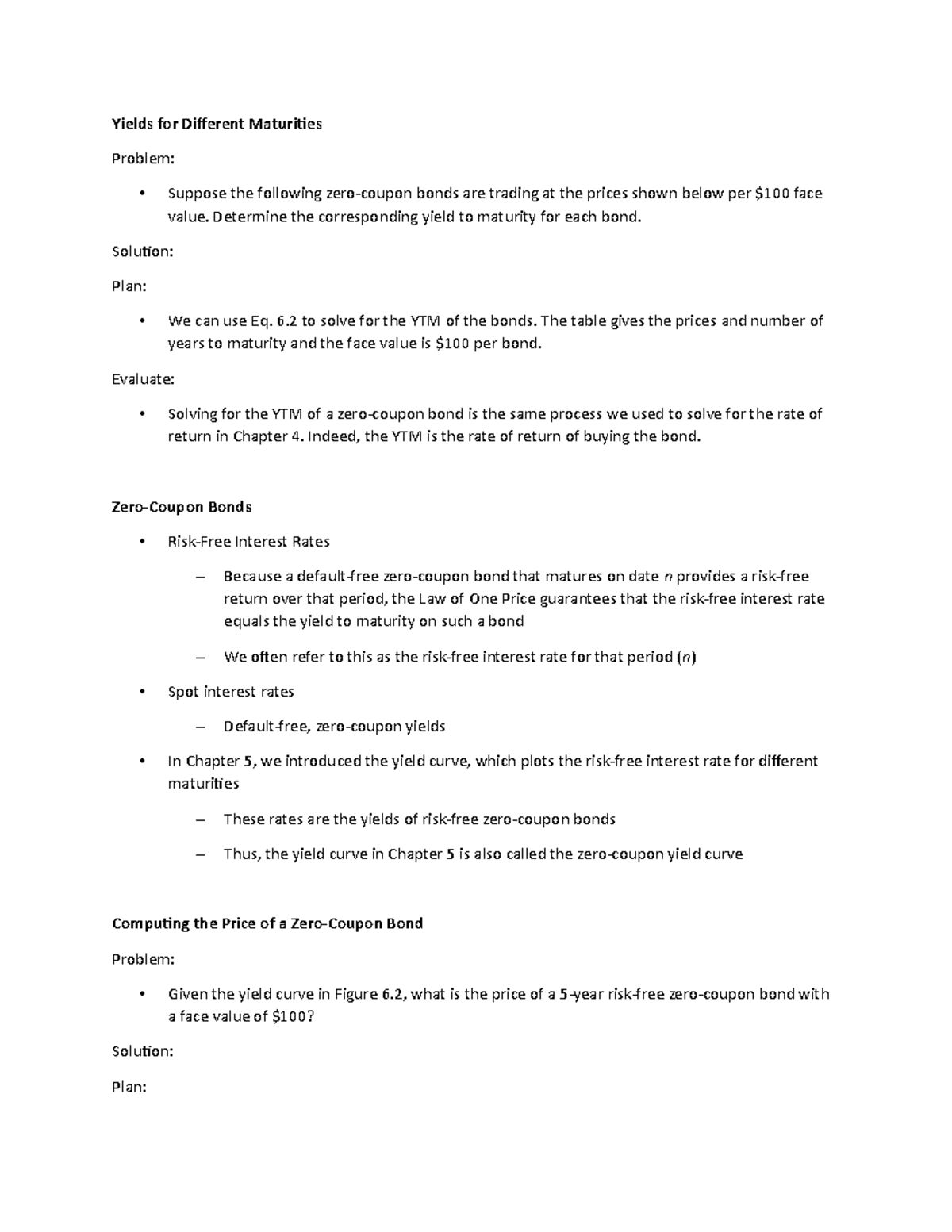

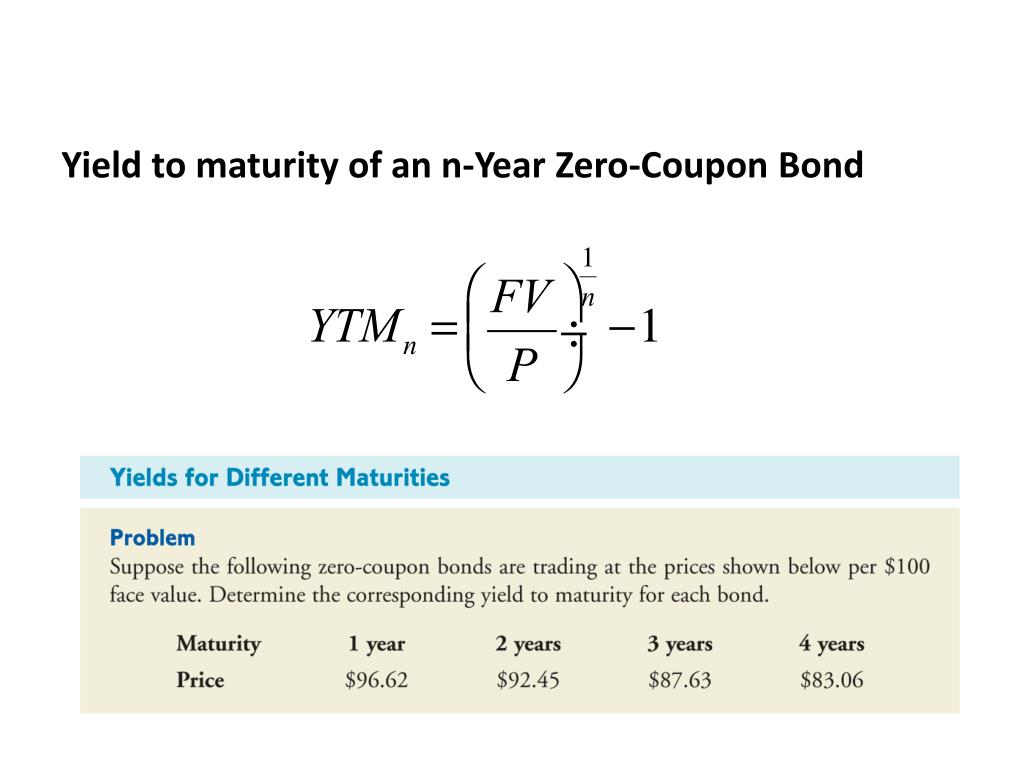

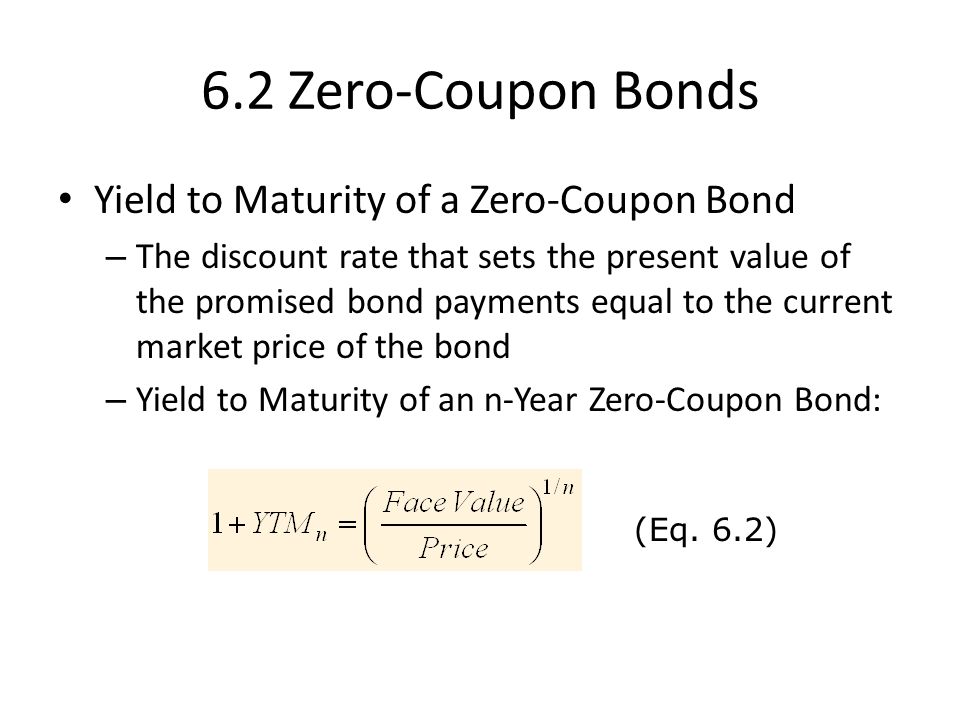

How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity . The bond is currently valued at $925, the price at which it could be purchased today. Interest Rate Statistics | U.S. Department of the Treasury WebNOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market …

Yield to Maturity (YTM): Formula and Bond Calculation - Wall … WebStep 3. Semi-Annual Coupon Payment on Bond Calculation. As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to arrive at the semi-annual coupon of the bond. Step 4. Yield to Maturity Calculation Example. With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM).

Ytm for zero coupon bond

Yield to Maturity (YTM): What It Is, Why It Matters, Formula Web31/05/2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield of zero-coupon instruments given price - MATLAB zeroyield Quasi-coupon periods are the coupon periods which would exist if the bond was paying interest at a rate other than zero. The first term calculates the yield on ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Web10/10/2022 · Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity . The bond is currently valued at $925, the price at which it could be purchased today.

Ytm for zero coupon bond. Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ WebP: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... Bond Yield to Maturity (YTM) Calculator - DQYDJ WebYou can compare YTM between various debt issues to see which ones would perform best. Note the caveat that YTM though – these calculations assume no missed or delayed payments and reinvesting at the same rate upon coupon payments. For other calculators in our financial basics series, please see: Zero Coupon Bond Calculator Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Bond: Financial Meaning With Examples and How They Are Priced Web01/07/2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

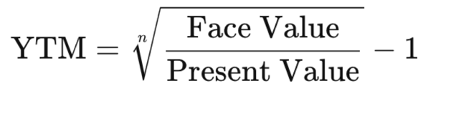

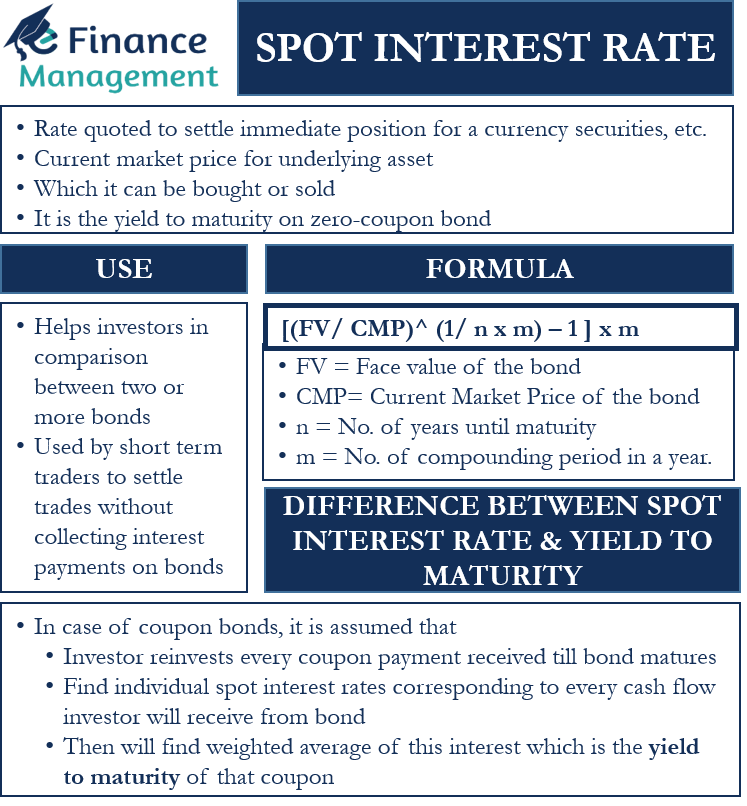

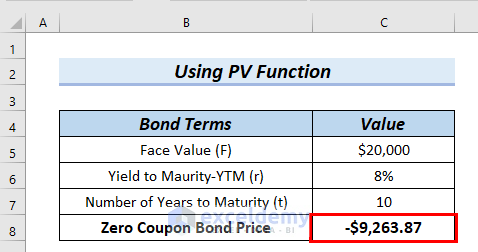

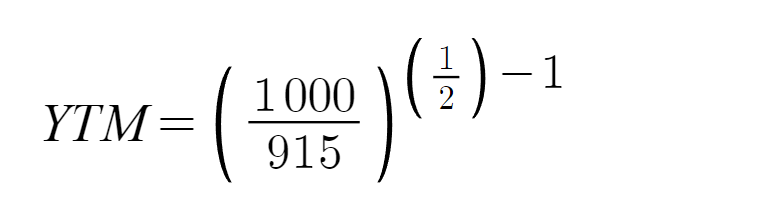

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … WebCalculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical bonds a … Zero-Coupon Bonds: Characteristics and Calculation - Wall Street … WebZero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. Yield to Maturity – What it is, Use, & Formula - Speck & Company There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / ... Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

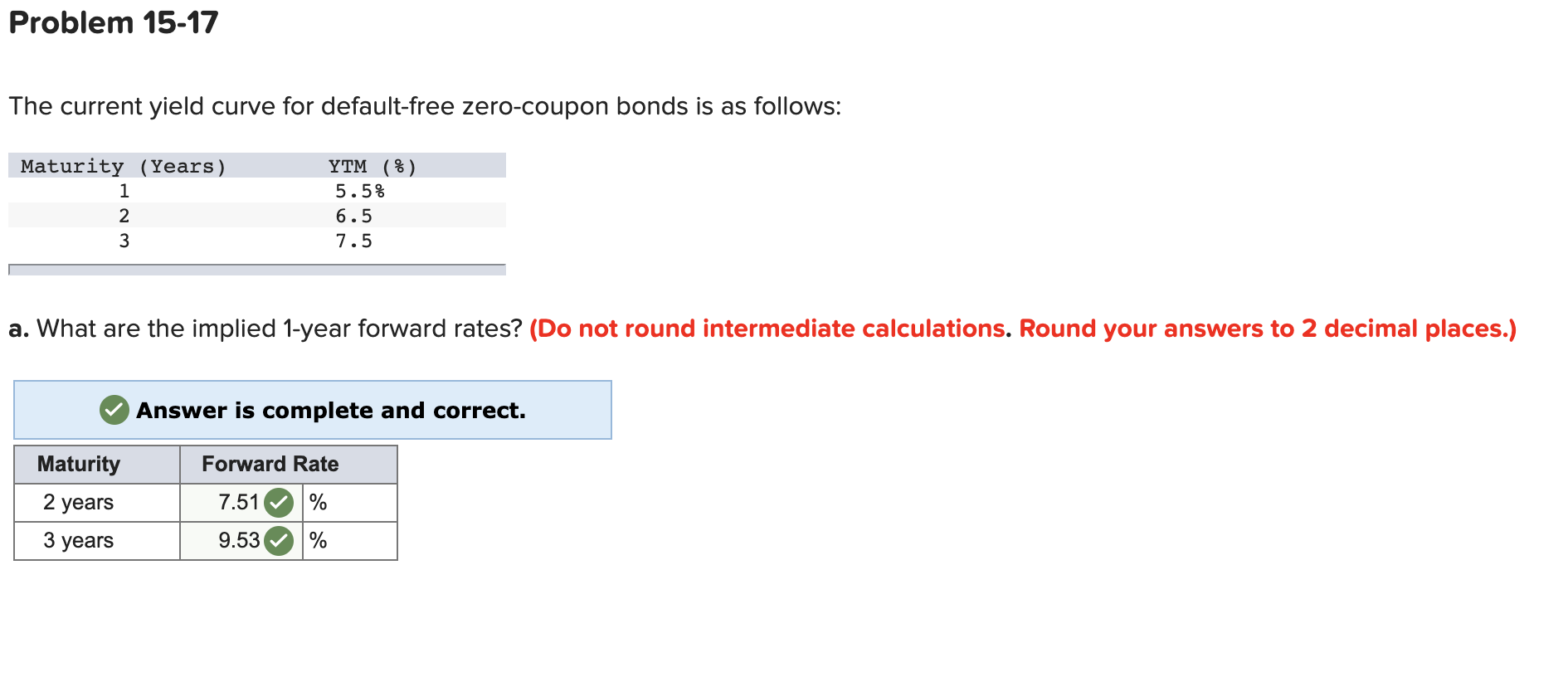

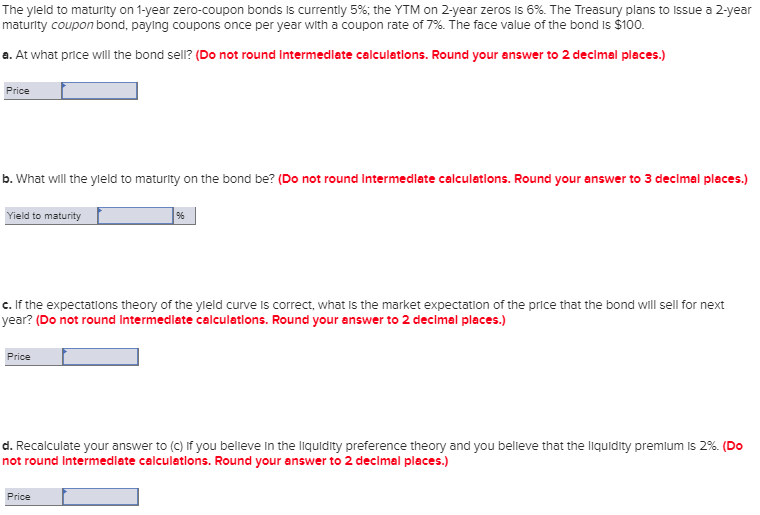

Zero Coupon Bond Yield - Financial Formulas (with Calculators) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. Bond Yield: Formula and Percent Return Calculation Discount Bond: YTM > Coupon Rate; Par Bond: YTM = Coupon Rate; Premium Bond: YTM < Coupon Rate; For example, if the par value of a bond is $1,000 (“100”) and if the price of the bond is currently $900 (“90”), the security is trading at a discount, i.e. trading below its face value. Duration Definition and Its Use in Fixed Income Investing Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ... 12. The current yield curve for default-free zero-coupon bonds is as ... Obtain forward rates from the following table: Maturity. (Years). YTM. Forward ... c) If you purchase a two-year zero-coupon bond now,.

How to Calculate The Yield To Maturity of A Zero Coupon Bond Jun 6, 2021 ... In this video I will explain what a zero coupon bond is and show you how to use the formula to calculate the yield to maturity of a zero ...

Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or ...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

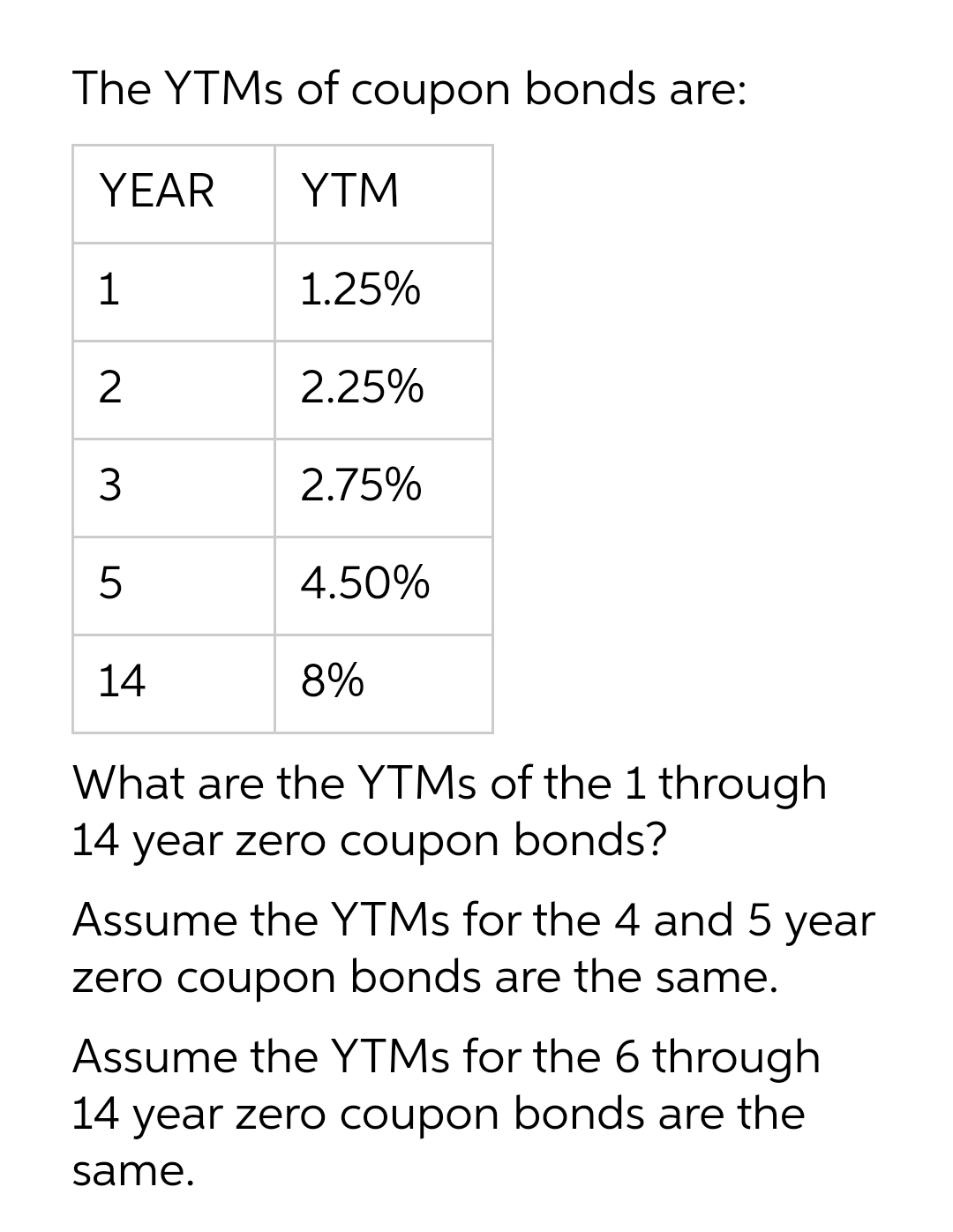

Yield to Maturity - NYU Stern Therefore, zero rates imply coupon bonds yields and coupon bond yields imply zero yields. Page 5. Debt Instruments and Markets. Professor Carpenter. Yield to ...

Duration Definition and Its Use in Fixed Income Investing - Investopedia Web01/09/2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

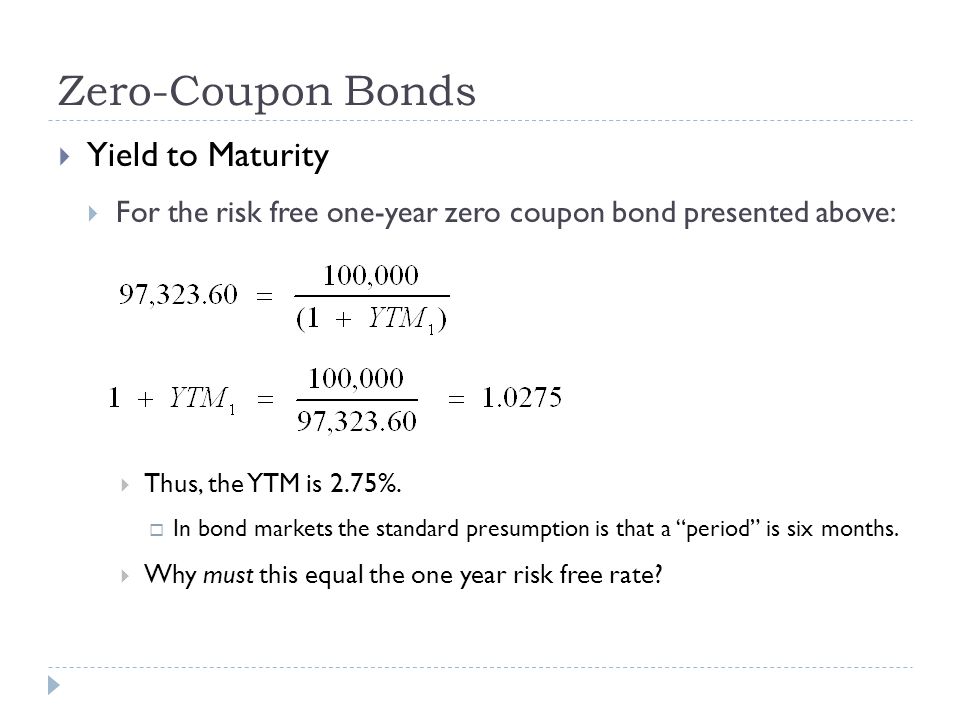

Zero-Coupon Bonds: Characteristics and Calculation Example To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then ...

Zero Coupon Bonds - Financial Edge Training Oct 8, 2020 ... Zero coupon bonds are different since they do not pay investors any interest payments between issuance and maturity. Instead, they offer ...

Yield to Maturity (YTM): Formula and Bond Calculation Step 3. Semi-Annual Coupon Payment on Bond Calculation. As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to arrive at the semi-annual coupon of the bond. Step 4. Yield to Maturity Calculation Example. With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM).

How to Calculate Yield to Maturity of a Zero-Coupon Bond Web10/10/2022 · Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity . The bond is currently valued at $925, the price at which it could be purchased today.

Yield of zero-coupon instruments given price - MATLAB zeroyield Quasi-coupon periods are the coupon periods which would exist if the bond was paying interest at a rate other than zero. The first term calculates the yield on ...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula Web31/05/2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Post a Comment for "39 ytm for zero coupon bond"